Combining Trading

&

With Machine Learning.

Computer Aided Trading... is it something that retail investors can do?

H aving been a developed on propitiatory trading system at several banks I thought, you know what, lets make one more. So to answer the question, out of the box, "NO".

As of 2019, automated trading and EU laws seem to be no-longer be compatible with retail clients for as long as the individual doesn't "white list" shares that the algorithm will be allowed to place the orders on. Ideally you would not limit a algorithm to any given share, it should just pick a contract to execute a trade on to achieve it's goal of realizing a profit without considering the underlying reasoning a human might have. performing a 3 minute trade on say TESLA, AMD, UGAZ, USD.EUR forex (buy & sell within seconds or minutes) does not need to consider the underlying macro economics. It's all about imbalance, financial models used by others and applied psychology.

One of the first things you have to solve is the legal hurdles of MiFID/ MiFiR, it basically comes down to does the investor make a informed decisions based on investment products he can understand. Lucky we know programming I have been able to integrate a contract pre-selection module where the user can select the shares he would like to day-trade on. A contract represents any financial instrument that is traded on a exchange as well as over the counter products like forex, commodities, futures and Pink slips to name a few. You can have a look at my rational in dealing with Article 19(4), 35 and 37 of the EU MiFID law here.

Computer Aided Trading System - C.A.T.S.

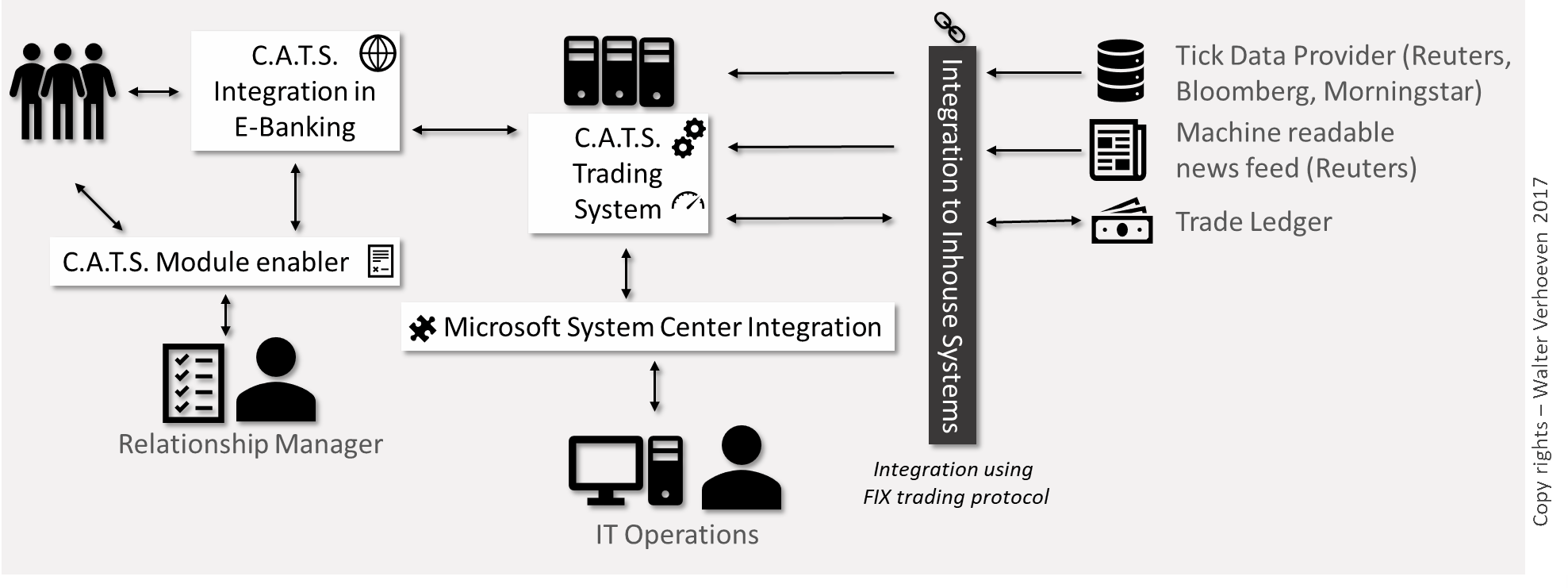

The solution has a modular design and will allow several use cases. Below I will show several of the options that CATS' can be configured. You will see that CATS can be used for single trader to a back-end service for a financial institute. To underline the success of the solution I am providing some links to show the execution from 21st of Jun 2017 to the 2nd of November 2017 of trading here and you can view the trades and the trade engine in action here where I uploaded some trades on YouTube.

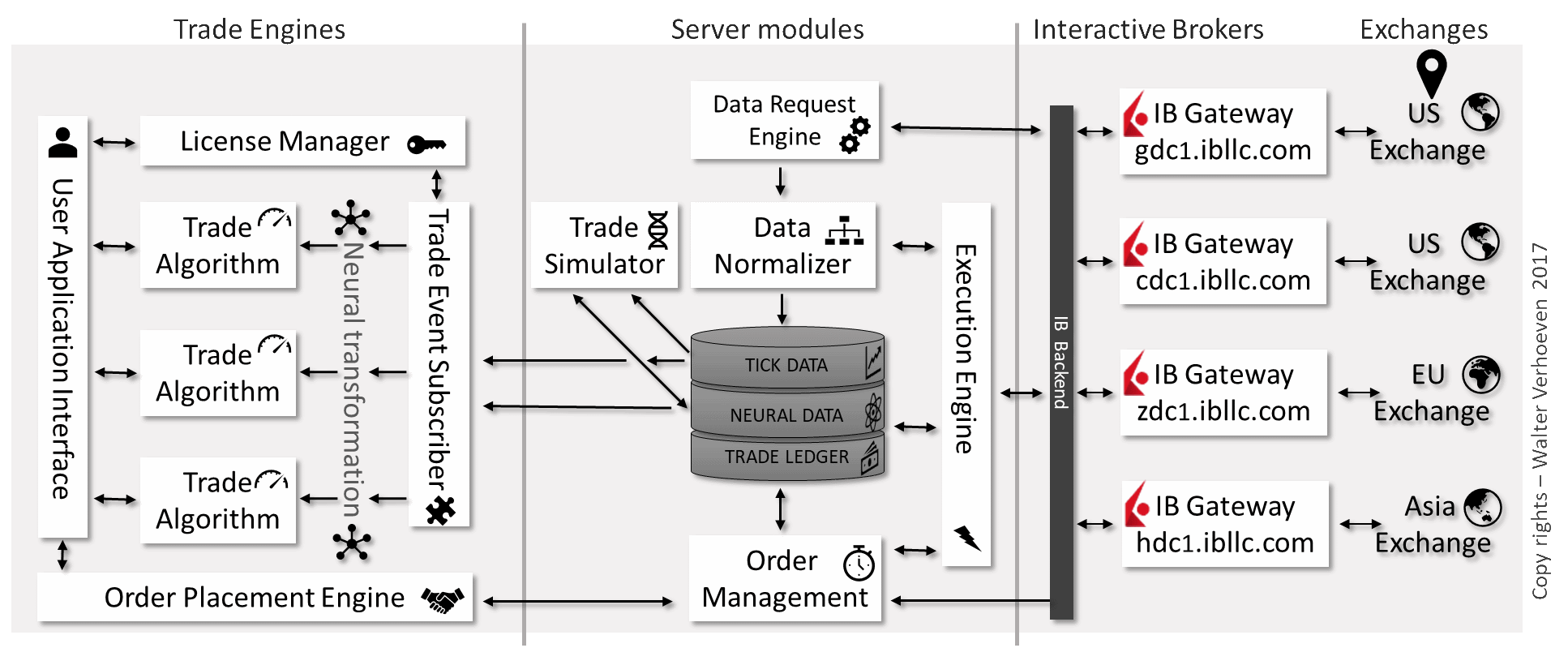

The system design

The modular design and service injections allow for a scalable solution. The system has been recorded to manage 32,000 trades simultaneously

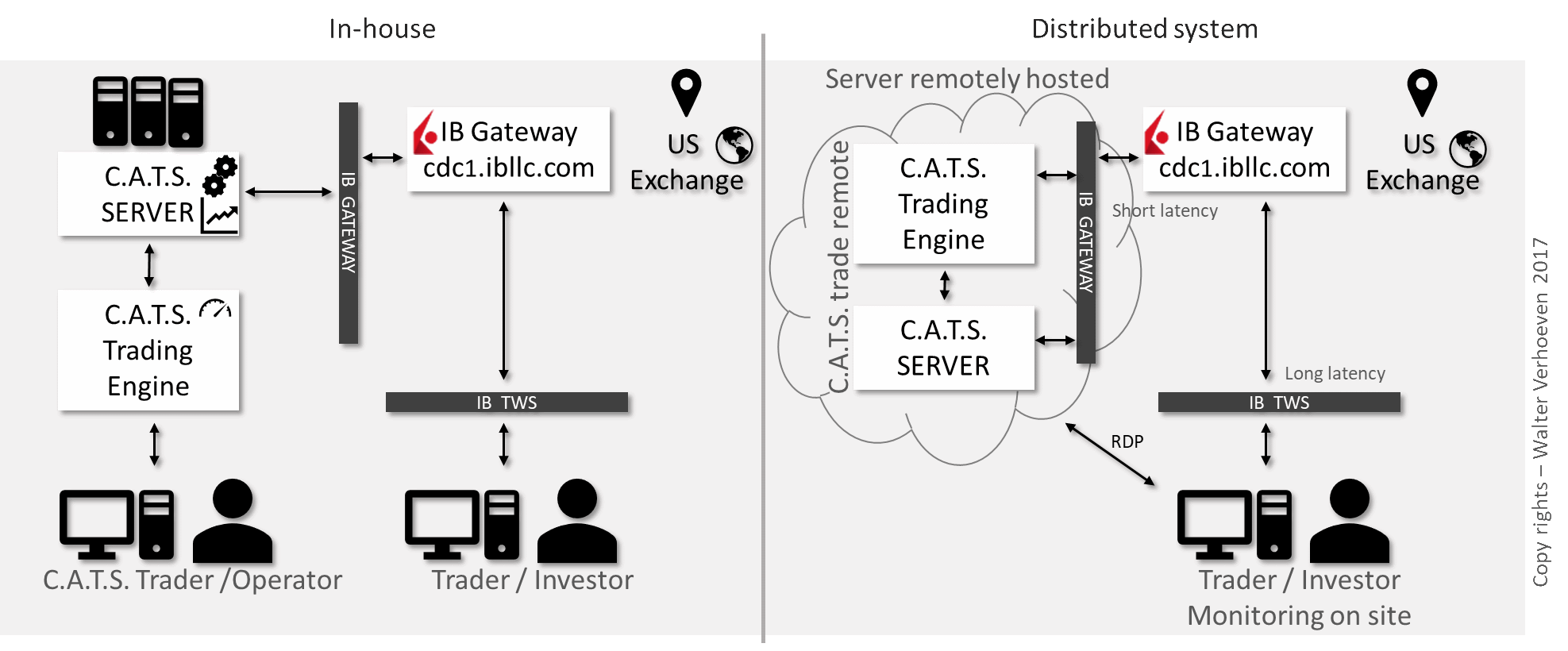

Configuration A: Proprietary trading single strategy

The system can be used on a singe computer or in a distributed configuration. Any one trading with up-to 50 instruments and a single geographical location can use a single system.

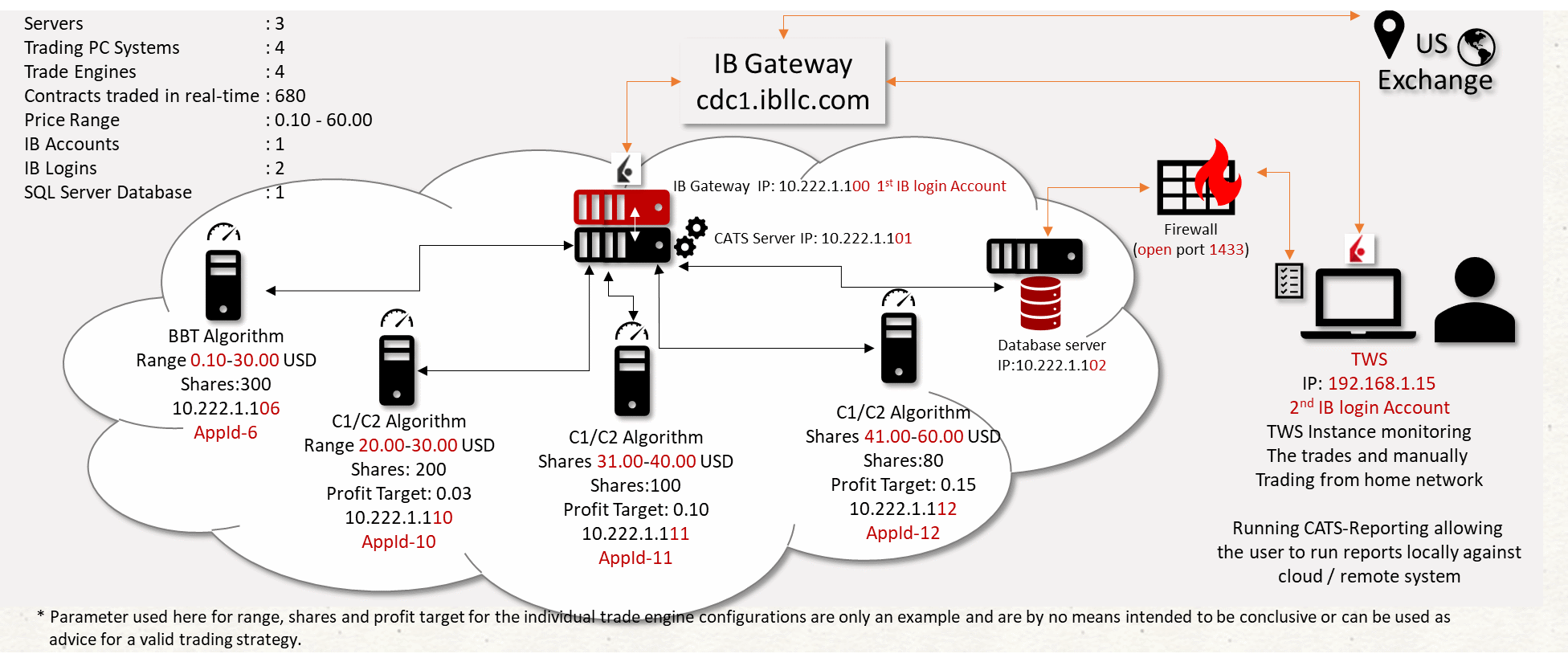

Configuration B: Load Balanced multiple strategies

A more sophisticated setup involving several trade engines with specific strategies are traded and controlled by a single TWS instance. A data-center can be used to have lower trade latency.

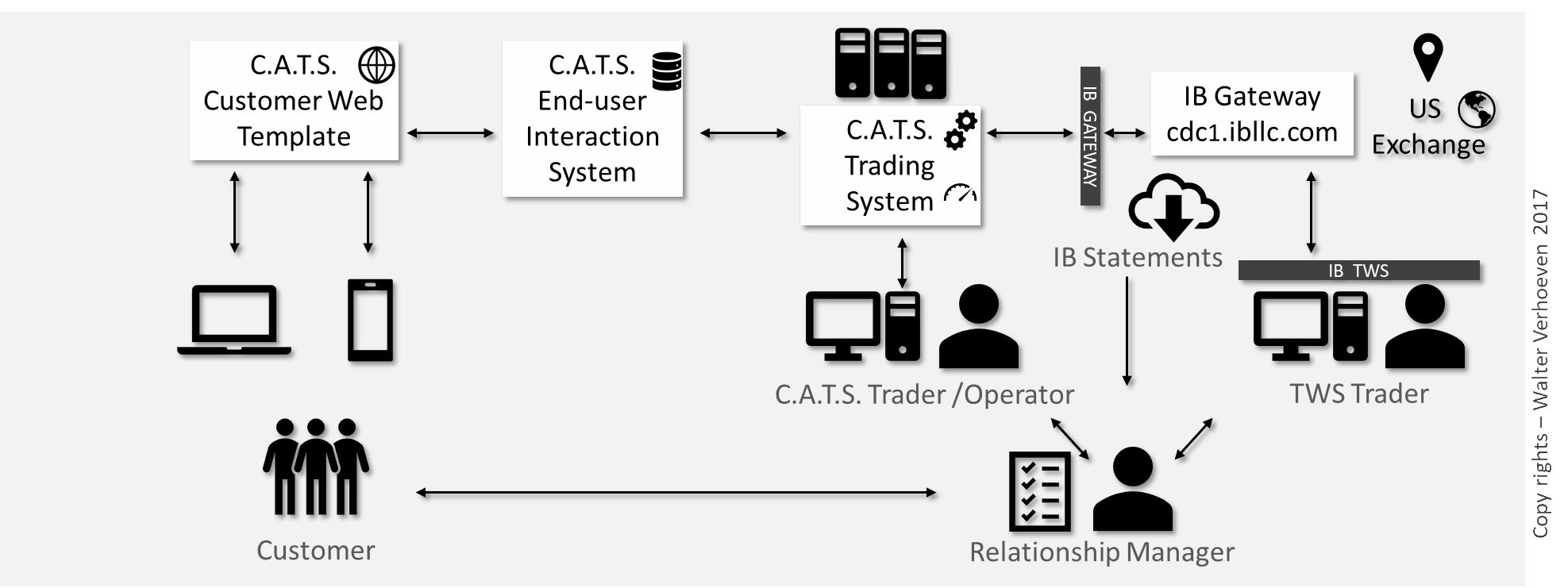

Configuration C: Asset Managers and SRO's

Trading for the customer, trading on multiple accounts and multiple customers, in real-time. This can be done in-house and/ or distributed.

Configuration D: Financial institutions

Integrate C.A.T.S. with existing infrastructure as application or by integrating proprietary source code Module with in-house software and own broker & equity.

Machine learning

As demonstrated above, the algorithms and strategies are effective at the moment, the problem though is that the neural networks must always be kept up to date as the markets change and other algorithms are being developed all the time. At the moment the Algorithm is trading and learning for:

- US, Asian UK, German and Swiss Equity;

- Identify trading patterns of other trading robots;

- FX Trading on the following FX pairs EUR.RUB, EUR.USD, CHF.RUB, EUR.CHF, EUR.JPY, USD.JPY, EUR.USD;

Note, depending on the market and jurisdiction you will need to consider legal requirements. Profits made in the past are no guarantee for similar returns on investments in the future. I recommend paper trading for a given duration until you are satisfied and understand the risks involved. To trade using CATS you will need to have your own interactive broker account or have a FIX compatible access to a broker or exchange.

CATS does not access or manage account nor does interactive brokers support money management using their API. You can read about interactive brokers API here. Interactive brokers makes it easy for developers to create trade platforms with sample projects and live support.

Contact me if you would like to use my CATS in the current version or if you would like more information. I will not trade for you nor will I trade with funds other than my own.